As employers take a more active role in managing total healthcare costs, some common themes are emerging.

A recent Business Group on Health large employer survey found that many benefit leaders are prioritizing virtual care solutions and developing more focused strategies to predict, and in some cases prevent, high cost claims.

Here’s a look at how self-insured employers are tackling these challenges today – and how advanced technologies paired with the right operational strategies are supporting their efforts.

Implementing More Virtual Care Solutions—Strategically

Even before the pandemic, many forward-thinking employers were investing in virtual care programs to realize the many benefits including convenience, efficiency, flexibility, and cost-effectiveness. COVID-19 has accelerated that process. The associated jump in investment has also made measuring the effectiveness of virtual care programs more vital—so that benefit leaders can see what’s working in near-real time and avoid dedicating additional resources to programs that consistently under-perform.

To get a handle on expanded solutions and programs, it can be helpful to separate virtual care into two buckets:

- Virtual care that is part of a discrete health or wellness program such as disease management, smoking cessation, nutrition, activity/fitness, etc.

- Virtual care that partly or wholly replaces in-person appointments for medication refills, mental and behavioral health therapy, PT, and other types of care that can be conducted virtually.

When it comes to the former, it’s important for benefit teams to have a way to measure the success of each program for the target population. KPIs include:

- Adoption (% of target population who start the program)

- Engagement (% who actively participate)

- Retention (% who stick with it)

- Impact (individual results/progress, qualitative feedback, trends within/across participating population)

- Outcomes (the holistic clinical and financial result at the member level, typically calculated annually as PMPY savings across medical and pharmacy benefits, that includes dollars saved based on reduced or preempted clinical risk factors)

Monitoring these KPIs and having mechanisms in place to take action on each one helps ensure programs don’t under-perform. For example, low adoption doesn’t necessarily signal a lack of interest in the program – it may just mean that the benefit management team needs clearer insights into which members are most likely to be responsive or which mode of outreach is most likely to be successful at the member level.

For the second virtual care bucket, programs that partly or wholly replace in-person care for routine appointments, employers and their health plan partners need a way to identify which members are most likely to use virtual care in next 12 months, and the types of healthcare services. From there, the teams can engage and educate those members to make sure they understand how best to use the benefits and services available to them. As part of this process, they can also gather qualitative feedback to ensure there aren’t addressable problems like insufficient provider capacity or device-specific technical difficulties that are limiting the success of the program or causing drop-offs in engagement after initial adoption.

Key questions to answer when measuring the success of existing virtual care initiatives and planning future investment include:

- Is medication adherence improving? Worsening? Staying the same?

- How is increased use of virtual care impacting costs month over month and year over year? How is it impacting cost and utilization across benefits?

- What would future costs (across benefits) look like if virtual care adoption targets were met?

- Is virtual PT delivering comparable or better outcomes? What about virtual mental and behavioral health?

- Is there sufficient virtual care capacity to accommodate the members likely to use virtual care in the next 12 months? To accommodate a jump in demand due to something like another lockdown?

Given that it’s not possible to answer these questions (and others like them) using traditional analytics and data reconciliation techniques, benefit leaders seeking to sharpen their virtual care strategy are best served by employing integrated, cross-benefit analysis and predictive modeling that can run on top of their data warehouse. It’s also critical that their data warehouse encompass all healthcare and benefits data and can normalize feeds from different vendors and wellness programs.

Creating a More Focused Strategy to Manage High-Cost Claims

Although healthcare costs continue to increase generally, high-cost claims are growing at an even faster pace – so it’s no surprise that many self-insured employers are seeking solutions to better manage this driver of total healthcare spend.

As with virtual care, segmenting the challenge can help benefit leaders focus their strategy and start taking action today.

Preventing Avoidable High-Cost Claims

Preventing avoidable high-cost claims starts with predicting clinical and financial risk. As a starting point when considering a predictive analytics solution, make sure vendors have the proven ability to accurately predict the probability that:

- A member will have an acute unplanned hospital admission within 90 days

- A member who had an acute unplanned admission with have an unplanned readmission within 30 days of discharge

- A pregnant health plan member with a 26-week pregnancy period will experience a high-risk pregnancy (defined as having adverse neonatal outcomes)

- A member will start dialysis in the next year (due to end-stage renal disease)

- A member receiving a congestive heart failure (CHF) diagnosis within the next 12 months

- A member becoming an emergency room over-utilizer within the next 12 months (with over-utilization defined as 3 or more unique ER visits in a year)

While these diagnoses and events can’t be prevented in every case, pinpointing the members at highest risk gives provider and outreach teams the best chance of intervening in time to prevent the most detrimental (and highest cost) outcomes. Early intervention is also critical to preventing future high-cost claims that can result from one of the above clinical risks – for example, the often difficult battle to treat an antibiotic-resistant infection acquired during an ER visit or unplanned hospital admission.

Predicting, Containing, and Mitigating the Impact of High-Cost Claims

Predicting high cost claimants (HCCs) even when there’s a lack of historical data has taken on newfound importance in the wake of COVID-19. An elevated percentage of workers are seeking new jobs, returning to the workforce after a significant hiatus, or actively planning to switch companies in the near future thanks to expanded remote work opportunities.

That means self-insured employers are likely to see an influx of new health plan members for whom there’s limited historical healthcare & benefits data available—making it more difficult to predict clinical & financial risk using traditional retrospective analysis.

Overcoming this challenge helps drive down avoidable high cost claims through earlier, more targeted intervention & outreach. It also supports strategic planning and more effective population health management overall, by enabling employers to ask and answer relevant questions like:

- Are the right solutions available to engage emerging HCCs? Or, more granularly:

- Is there capacity and a pathway in place for an employee with emerging diabetes-related risk to start a preventative care or wellness coaching program immediately after being hired?

- What’s the financial risk of delaying screenings or intervention for that employee?

- Are future HCCs concentrated in a particular city or geographic region? If so, what’s per-member financial risk for that subpopulation, and what can be done to target outreach to that location?

- What progress is being made toward closing relevant gaps in care for emerging HCCs?

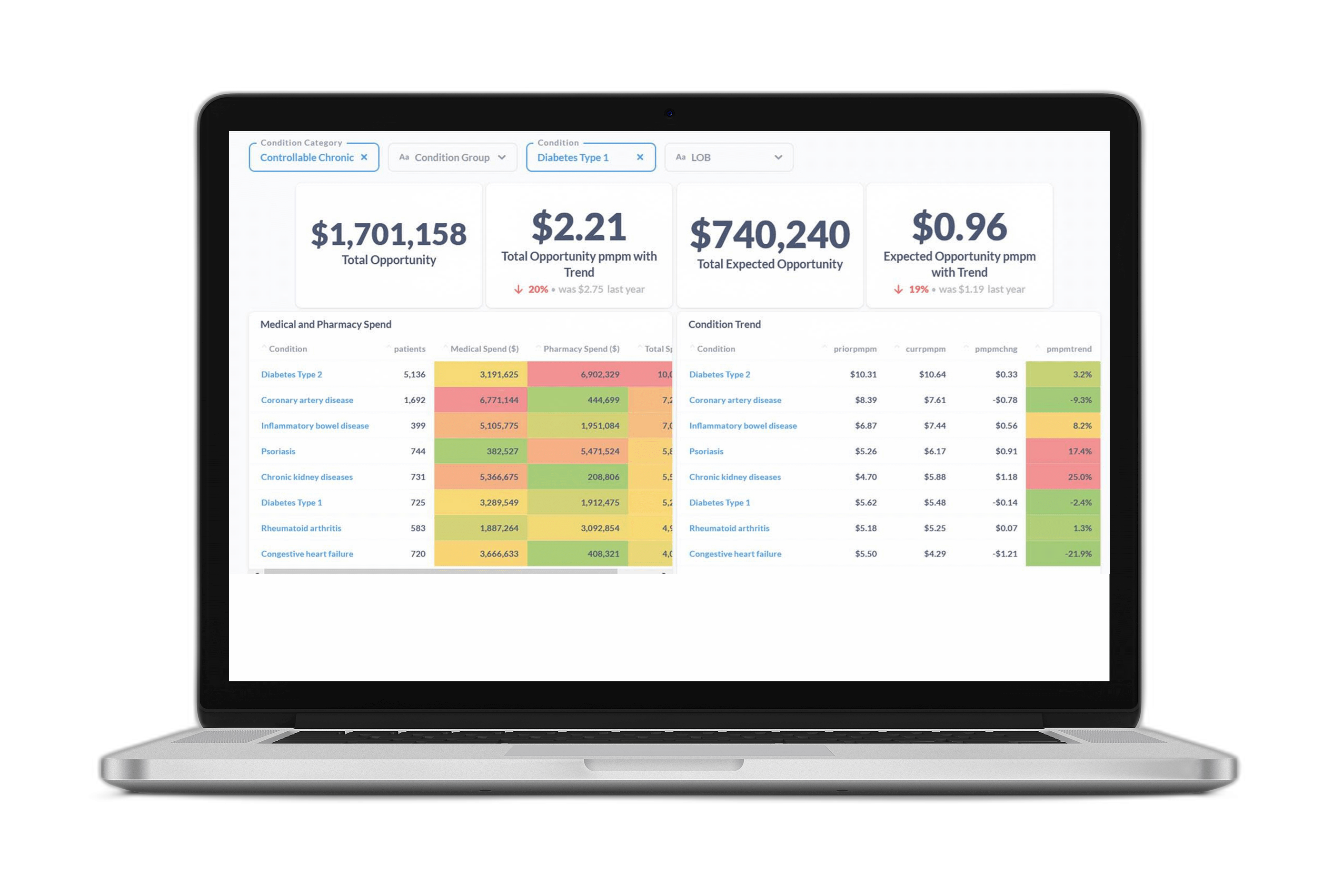

Gaining a more complete picture of pharmacy utilization can also help contain high cost claims, and lead to significant savings overall. With holistic, integrated pharmacy reporting, employers and their healthcare partners can ask and answer questions like:

- Are there discrete patterns of pharmacy-related avoidable overspending across a meaningful number of high-cost claims? (Example: insufficient use of biosimilars.)

- Are there healthcare provider and/or benefit utilization patterns that make members higher cost than comparable peers with the same care needs? (Example: a specialty drug being administered in an outpatient setting when it could instead be administered in the home – a typically lower-cost option that many patients actually prefer.)

Pairing integrated pharmacy reporting with the predicted financial impact of specialty drugs currently in the FDA approval pipeline also supports smarter stop-loss insurance planning. In addition, it clarifies the dollar amounts that would be saved through delaying coverage for a newly approved drug until the employer’s PBM has more data on efficacy and safety—and shows exactly where indication- or outcome-based pricing would have the greatest impact overall or within a specific population.